Remove PMI – Save Big Money – Smile

THIS is Opportunity Knocking.

In Fact, It’s Kicking Down the Door!

You are about to discover how you may be able to save thousands of dollars by eliminating PMI (Private Morgage Insurance) from your mortgage. This is not a gimmick or hard to do, although not every home may qualify for it. We are here to help you determine if you qualify and then guide you every step of the way through the process. So, sit back, buckle up, and enjoy the ride!

What This Is About

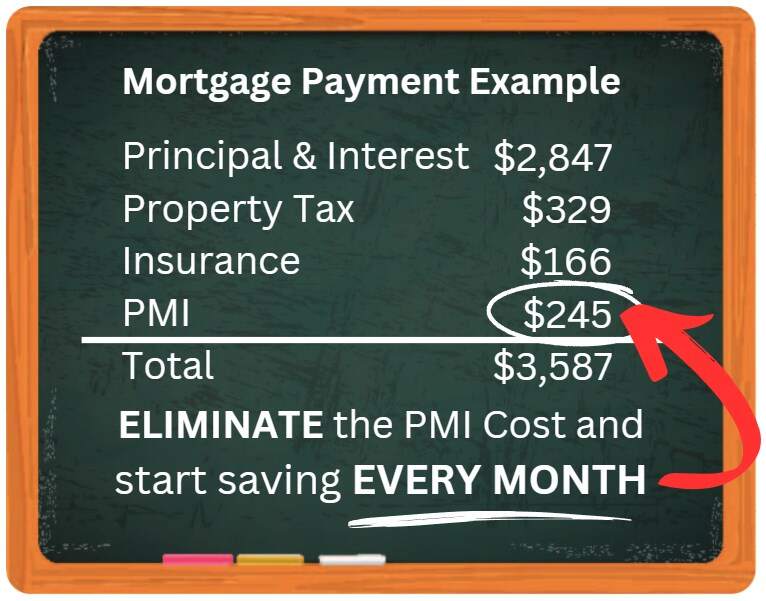

If your mortgage loan is a conventional loan and you have less than 20% equity, you are probably paying a few hundred dollars a month for PMI. Many homeowners have eliminated this by evaluating what their home is worth TODAY. More details below…

This is Easy to Start

We have a detailed form for you to fill out so we can perform preliminary research to see if your home qualifies. This can be completed right now on this site, and it is fast and easy. Every home is unique, so our research may take a day or two.

Save Thousands

Your PMI savings can add up to thousands of dollars every year. Your lender can “show some love” by eliminating PMI premiums off your mortgage. Get started today and start building a mad money reserve – just in case you get… mad.

Congratulate Yourself

This can usually be accomplished within a few weeks. Appraisals can be complicated, but don’t worry – that’s what we’ve been doing for over 20 years. You’re in good hands. We have the experience and expertise to guide you from start to finish.

The Plan and How it Works

When you have 20% equity in your home you should not have to pay PMI (Private Mortgage Insurance) if you have a conventional loan. VA and FHA loans have different rules, so this does not apply to them. This PMI can be eliminated from your monthly payment when you have 20% equity in your home value. As an example, if you purchased a home for $500,000 and paid a 20% down payment of $100,000, you would owe a mortgage of $400,000, which is 80% of the home value – with the remaining 20% of the value being your equity. You would have 20% equity and therefore would not be paying PMI. If, on the other hand, you owed $470,000, you would have less than 20% equity and the lender would charge you a monthly fee for PMI. To eliminate the PMI charge you can pay off $70,000 of your mortgage – or – submit an appraisal if the current value is 20% more than what you owe on your mortgage. After the appraisal is submitted, the PMI charge is removed.

Our expertise is analyzing your home to determine if the value has increased 20% or more from what you now owe on your mortgage. The preliminary research phase is not an appraisal – it is a CMA (comparative market analysis) which are typically prepared by real estate agents. This research is prepared for no charge. Being that I am also a licensed real estate broker, I prepare CMAs. If the CMA research results in you now having 20% or more equity in your home, we would then proceed to prepare a full appraisal that will meet your lender requirements to remove the PMI charge. CMAs, although similar, are different than appraisals and are not interchangeable. We will guide you through the process, step by step.

Please note that not all homes may qualify for this assistance, as there are many variables to take into account. There is no charge for our CMA services. You are only charged if you decide to proceed with an appraisal to submit to your lender.

Rick Stillman

Appraiser

Real Estate Broker

If This All Sounds Too Good to Be True…

Sometimes things sound too good to be true and people may think there’s a catch, or it’s just not true at all. It’s good to be careful. This, however, is not a scam or anything new. It is common and has been around for many years. Your lender can verify this. But not a lot of people have even heard of PMI. Lenders are certainly not eager to inform you of how it can be eliminated. Next question – who am I and why should you work with me?

I work with a highly skilled team of experienced appraisers. I am the lead appraiser who does the detailed research and analysis involved in PMI removal appraisals. Not all appraisers have the same level of expertise or experience. I like to compare appraisers to doctors. The doctor who provides flu shots likely would not be able to perform a hip replacement. Doctors can specialize in many different fields, while some don’t specialize at all. The same can be said for appraisers. PMI removal appraisals require more detailed analysis than most other types of appraisals because they are highly scrutinized. When dealing with the largest investment of your life, seek out the best experts you can find. Quality and experience pay dividends.

When I first started as an appraiser over 20 years ago, most of my appraisals were for purchase and refinance transactions. Over time, I developed a specialization in “complex” appraisals, such as high-end homes and appraisal litigation work, which focused on divorce and estate valuation appraisals. I am a court-certified expert witness for appraisal work. This level of appraising is generally much more thorough and detailed than refinancing or purchase transaction appraisals. These are important distinctions in appraisals that few people are aware of.

I have also been a real estate broker since 2007 and am glad to help you with the sale or purchase of your next home.

YEARS OF EXPERIENCE

Happy Clients

Properties Analyzed

This Could Be You.

This is closer than you may think. Within a few weeks you could stop throwing money out the window and into a slush fund instead.

The next step is to download our form so we can begin research on your property and market area.

And we’ll take it from there. We’ve been doing this for a very long time and have state-of-the-art systems and procedures in place. You are now at the part where we say, ready, set, go!

We look forward to working with you, and after this is all said and done, we hope you inform your friends and family how they too can find their own little pot of gold!

A Few Questions We Get Asked…

Most property appraisals cost $600 to $1,100, with an average being $800. If they have exceptional features, such as backing to a golf course, or being in an isolated rural area, they may cost more. We accept cash, check, and credit card billing as an option to help manage the fee (credit card billing is through a third-party company).

Appraisals are regarded by lenders, attorneys, and CPAs to be the “official” standard of quality that is acceptable for real estate transactions. There are extensive rules and regulations that direct how appraisals are to be created. A lender, especially, wants to protect their investment securing a mortgage with as solid of proof as possible. Just as electricians, plumbers, and doctors are trained and licensed to perform their work, the same is true for appraisers.

To avoid having someone pay for a full appraisal that they cannot use, we first perform preliminary research to analyze comparable properties which are similar to your home. We will then have somewhat of an idea of the value range that your home may appraise for. If that data is not available, or not able to be used, we stop there and do not charge for work up to that point. This is a CMA (comparative market analysis). As this is not an appraisal at this point, there is no charge for this level of research. If, on the other hand, you determine the data will be usable for your purposes, we will then create a full appraisal based on the information we have obtained. An appraisal and a CMA, while similar, are two different things and serve different purposes. Lenders do not accept CMAs for PMI removal.

IF it is decided to proceed with a full appraisal, fees are due on or before the date of inspection. We will provide details as our research progresses. Because a full appraisal requires a lot of time and work, appraisal fees are not refundable. We accept cash, check, and credit card billing as an option to help manage the fee (credit card billing is through a third-party company).

Appraisals are typically finished within 9-15 days after the inspection and are delivered by email in a PDF file format.

Be a VIP

You can be in the know about everything real estate. Our buyers and sellers get advance notice of select homes before they hit the market. We also have access to deals and promotions that can give you an edge in the market to save big money. Stay in the know. It’s important – it’s interesting – and it’s free. Unsubscribe anytime. We don’t share your information with anyone.

Let's Get Started!

Just click the button below to fill out our home survey form. Embrace the day!